Author: nfzurawsky

Income Inequality PSA

Here is a link to a PSA I created for the Pittsburgh Human Rights City Action Plan

Income Inequality Interview With Stefania Albanesi

The Fall of an Empire

Reasons for the Fall

Rome did not fall in a day, it fell methodically and predictably. Many many factors contributed to the weakening grasp and eventual abdication of the Roman empire. For starters, the rise of Christianity as a dominant religious force was sweeping throughout Europe. Christianity clashed starkly with the Roman religion. Christianity was monotheistic and Roman mythology polytheistic. Christianity was especially popular amongst the poor because it encouraged individualism. It spread so rampantly that eventually the Roman empire adopted it as the official religion. Unfortunately this clashed with Roman centers of control (which were based on power given by Roman deities) and undermined the Roman leadership. In Roman mythology the emperor was literally a god and thus his word was the rule. But Christianity believed in only one God, which was decidedly not the Roman emperor. Today, there is another crisis of religion among the population; not a shift from one religion to another but a movement away from the idea of a higher power. This, as with all religious schisms and movements, is creating turmoil within communities and causing us to rethink what it means to be a Good Samaritan, but this is not an essay about religion.

The Job

Back in 2013 I worked in the Bagel Factory. Not on an assembly line like those that are scant and well-paying with unions and extra-monetary benefits. The Bagel Factory is, for all intents and purposes, a fast food restaurant where patrons come in, order a coffee and a bagel with one of 10 different kinds of schmear, pay up at the register and leave, all within 15 minutes. It was decidedly one of the more depressing jobs I have had the fortune to work at for less than a year. What was depressing about it was my coworkers.

The manager, the richest of us all, was closing in on 60 years old. She presented herself as a strict old lady with chronic hip problems, though she was as kind as they come if you did your job right and worked through her craggy exterior in-between duties. She sat on her three-legged throne at the cash register, the only stool behind the counter, and dispensed justice among the workers, and change among the customers.

Her position was the envy of many of my co-workers. Despite the fact that she constantly complained about it, she’d had the job for nearly twenty years. She had the same courtiers you would expect to find surrounding the C.E.O. of a more well-to-do company, courtiers who were not even strictly loyal to the job of bagel-slinging. All of my co-workers who were not (like me) in their early twenties and planning on bailing as soon as an excuse presented itself, worked more than one job. When a company gives its employees around 30 hours a week the employees are able to request benefits, which the company has to pay for. Suspiciously, almost all of the employees at Bagel Factory got just under 30 hours a week which forced them to pursue other jobs if they wished to be employed full-time, though still without benefits.

Instability

When Rome fell, the Gini coefficient—a measurement of the gap between rich and poor where 1 is complete inequality and 0 is perfect wealth equality—was .43, which is incredibly high. We have evidence that, before its collapse, the Roman elite were moving out of city centers to the suburbs and removing themselves from positions of power. There is archaeological evidence of a spike in fortified villas that popped up far from population centers before the fall of Rome. This only further destabilized Rome as the centers of wealth moved away from the centers of population which caused the circulation of that wealth to stagnate. There are records that mistrust was breeding between the wealthy and commoners who suspected that they were no longer getting their cut of the Roman empire’s wealth. Rome’s near constant state of war did not help its finances either. Even Roman armies were not immune to this lack of wealth distribution. Less effective German mercenaries were being hired because they would accept less pay than Roman soldiers. This led to Rome being unable to fight against the increasingly incessant barbarian attacks at its borders.

Fall of the Factory

When I quit my job at the Bagel Factory it was in a state of disarray. We were getting less and less daily supplies from the owner and would consistently run out of the same foods before the store closed. We had lighting issues, freezer issues and problems with the microwave, some of which were had been broken and not fixed for the entire 6 months I worked there. More and more it felt like the store owner and his close buddy, our manager, knew the ultimate fate of the Bagel Factory and did not want to spend any more resources on what they knew was a doomed venture.

Today, years later, the Bagel Factory still stands defiant against what seemed like certain destruction despite rising property rent and utility costs in the area. I do not know if the change was an internal one—a changing of the guard on that 3-legged throne behind the cash register—or if there is a new owner that runs a tighter ship. But I can only hope that the company remains above water for the sake of my co-workers who may still work in the same positions that they will be for another four years, and another four after that.

Resources

(1) Business Dictionary, “gross domestic product (GDP)”. http://www.businessdictionary.com/definition/gross-domestic-product-GDP.html 2018

Definition of gross domestic product from Business Dictionary

(2) CIA World Factbook. “DISTRIBUTION OF FAMILY INCOME – GINI INDEX” https://www.cia.gov/library/publications/the-world-factbook/rankorder/2172rank.html

CIA world factbook showing gini coefficients of each country from worst to best. America is in the bottom 50% at 41/156.

(3) College Board. “Average Rates of Growth of Published Charges by Decade”, The College Board.https://trends.collegeboard.org/college-pricing/figures-tables/average-rates-growth-published-charges-decade 2018.

Chart showing increasing cost of two-year and four-year colleges. Increases larger than general inflation.

(4) Friends of Bernie Sanders, “Income and Wealth Inequality”, Friends of Bernie Sanders. https://berniesanders.com/issues/income-and-wealth-inequality/ 2016

Information about wealth inequality from Bernie Sanders campaign website.

(5) Gallagher, Sean M. “Income Inequality in the United States: A Call to Action”, Georgetown University. https://repository.library.georgetown.edu/bitstream/handle/10822/558349/Gallagher_georgetown_0076M_12060.pdf?sequence=1&isAllowed=y March 26, 2013. Washington, D.C.

Thesis paper from a Georgetown University graduate. It has lots of useful information on all aspects of income inequality in America today.

(6) Glazer, Sarah. “Universal Basic Income”. CQ Researcher. http://library.cqpress.com/cqresearcher/document.php?id=cqresrre2017090800 September 8 2017.

Article on the pros and cons of universal basic income.

(7) History staff, “The New Deal”. http://www.history.com/topics/new-deal 2009

Article describing the New Deal as proposed by FDR.

(8) Open Stax, “Government Policies to Reduce Income Inequality”. BC Open Textbooks. https://opentextbc.ca/principlesofeconomics/ May 18, 2016

An online book about the principles of economics. I mainly used the chapter 14 “Poverty and Economic inequality”

(9) Piketty, Thomas. Saez, Emmanuel. “INCOME INEQUALITY IN THE UNITED STATES, 1913-2002*”. UC Berkeley. https://eml.berkeley.edu/~saez/piketty-saezOUP04US.pdf November 2004

Paper on the recent history of economic inequality in the US from Berkley college.

(10) Tyson, Laura D’Andrea. “Income Inequality and Educational Opportunity”, The New York Times. https://economix.blogs.nytimes.com/2012/09/21/income-inequality-and-educational-opportunity/ September 21st, 2012.

Article from the New York Times on economic inequalities impact on education.

(11) U.S. Senate Committee on Health, Education, Labor & Pensions. “IS POVERTY A DEATH SENTENCE? The Human Cost of Socioeconomic Disparities”. https://www.sanders.senate.gov/imo/media/doc/IsPovertyADeathSentence.pdf September 13, 2011.

Paper by Bernie Sanders explaining the health issues that come with being poor.

(12) Johnson, Mathhew. “A Brief History of Income Inequality in the United States”. https://www.investopedia.com/articles/investing/110215/brief-history-income-inequality-united-states.asp November 2, 2015

Article on the history of income inequality in America beginning in 1913.

White Paper

INCOME INEQUALITY:

THE ONCOMING DOWNFALL OF AMERICA

Nicholas Zurawsky

University of Pittsburgh

2/14/2018

Introduction:

Income inequality is the worst it has ever been in America since the beginning of the 20th century. Recent laws, such as the newly proposed tax cuts and the plan to roll back the estate tax, have increased income inequality. These bills are similar to those introduced in the early 80’s to increase job growth, but also began this trend of growing inequality. (5)

On top of this inequality crisis America is facing there is another looming threat that will soon exacerbate this problem to unprecedented levels. This threat is the inevitable onset of automation. Machines today have gotten more and more complex and are able to do many tasks that were once thought to be exclusively human. Throughout history we have seen many examples of similar scenarios. We improved agriculture and moved from an agrarian society to one in which only a very small portion of the population needs to work to feed the entire population. We have automated factories so much that there was a shift from factory jobs being the base occupation of the working class to service jobs now filling that role. Another shift is now happening with machines that are able to fulfill the role of service employees or truck drivers, and although the cost of these machines are prohibitively expensive, experts (such as Elon Musk and Bill Gates) warn that it is only a matter of years before these replacements become economically feasible.

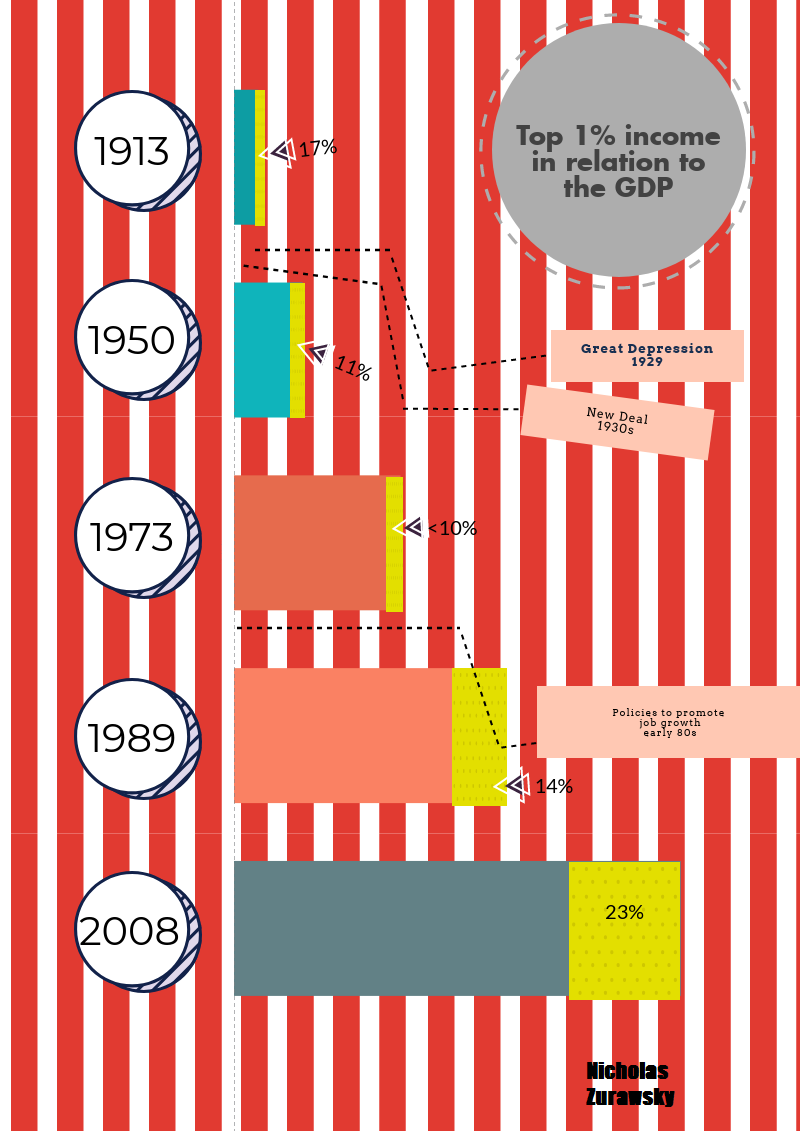

Chapter 1: How did we get to the current state of income inequality?

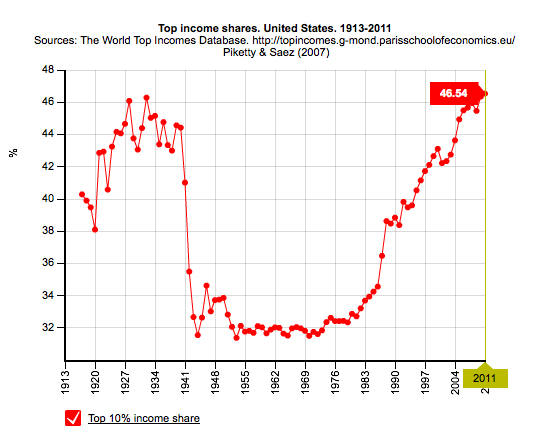

In 1913 a study was conducted of the American economy. It found that about 15% of the total income of America went to the nations top 1% of income earners. This sparked outrage and led to the introduction of a new income tax proposal that was similar to the one we have now. Even then it did little to redistribute wealth, however, it did put a stop to the wealthy’s free reign and general abuse of their workers rights. Unfortunately, income inequality continued to rise until the great depression (when the stock markets crashed America’s total income across the board fell) from 1929 to 1939. This served as a sort of “hard reset” for America’s economy. By 1941 the top 1% of wage earners took less than 10% of America’s total income. Many of the fortunes from before the great depression never recovered and this sent America on a new trajectory. (12)

The great depression laid the grounds for massive policy reform. Tax rates increased dramatically and the New Deal gave workers and unions much more power over their income and quality of life. This amazing balance in America’s economy lasted almost three decades and is considered a “golden age” for America’s working class. At the beginning of the 1970’s however, unemployment grew and wages began to stagnate. Throughout the 70’s and 80’s, as a result of new policies designed to increase job growth, and a growing distrust of unions, income taxes decreased from 70% to around 50% and union membership fell drastically. (7)

Figure 1.1

This decline corresponds to the to increase in income inequality seen in that time period. From the mid 1980’s until the beginning of the 21st century the top 1% took away about 20% of pre-tax income. The 2007 to 2009 housing crisis actually took a major toll on the income of the top 1% with their income falling as low as 13% of America’s total income. This is because many top earners make their money in volatile markets, such as housing. However since then, via various recovery methods, the top 1% have returned to their previous position of taking home 20% of pre-tax income while, as of data from 2014, the earning power of the bottom 50% of the United States has actually decreased since 1980. (9)

Another reason for growing unemployment and inequality is the advent of new technology and methods of automation. Technology is especially different today. It used to be that when a factory job was automated the human labor that was replaced was moved to new jobs such as machine operation and maintenance. However, since the late nineties the advent of computers has changed this formula. One computer with one operator and technician can replace the jobs of dozens, or even hundreds, of low to middle-class jobs from manufacturing to clerical work. This creates a population of displaced workers who now have two options: Seek minimum-wage jobs to afford a living, or get an education to compete for the new jobs at the company that are fewer than before and now require a degree. This new class of minimum wage retail workers has further issues. The decline in labor unions is yet another cause of reduced wages. In the 50’s and 60’s, America’s best years for income equality, union membership was around 33% of the workforce. Today, it is about 11%. (12)

Income inequality in America today is at the same level that it was before the great depression in 1928. If something is not done about it soon it could have disastrous effects on America’s economy as well as the World’s.

Chapter 2: Indicators

One of the most popular indicators of income inequality in nations is called the Gini coefficient. In an economically equal society, any percentage of the population that you looked at would make that percent of the total income. If you were to graph this out it would look like a 45° angle (as seen in figure 2.1). Of course, no society that has ever existed looks like this. The actual distribution of income in a society as represented by a graph is called the lorenz curve and the difference in area between the lorenz curve and the ideal 45° angle is called the Gini Coefficient. This has been used to measure income distribution all around the world. The more progressive countries in Europe such as Germany and Sweden have a Gini Coefficient around .3 (That is, 30% of the area in the perfect distribution is between it and the Lorenz Curve.) Whereas, in the more unequal countries like Papua New Guinea and Haiti the Gini Coefficient is .5 or more. (5)

Figure 2.1

America’s Gini Coefficient (as of 2014) is around .45, which unfortunately places us behind countries such as Iran and Kenya. (2)

The most recognizable indicator of wealth in a country is the Gross Domestic Product or GDP. GDP is the measurement of the “the value of a country’s overall output of goods and services (typically during one fiscal year) at market prices, excluding net income from abroad.” Unfortunately, the GDP is not a great way to determine income inequality as it is a total of all income. However, it gives us some perspective on what the Gini coefficient means for each country. America’s Gini coefficient is rather poor but our GDP is the third largest in the world after China and the European Union.(1) This does mean that despite our egregious income gap we still have some of the most wealthy lower and middle class in the world.

Chapter 3: Problems

So what are the problems associated with income inequality? Though it is extremely obvious to most people that this gulf between rich and poor is bad, the specifics are widespread and ominous.

- Education:

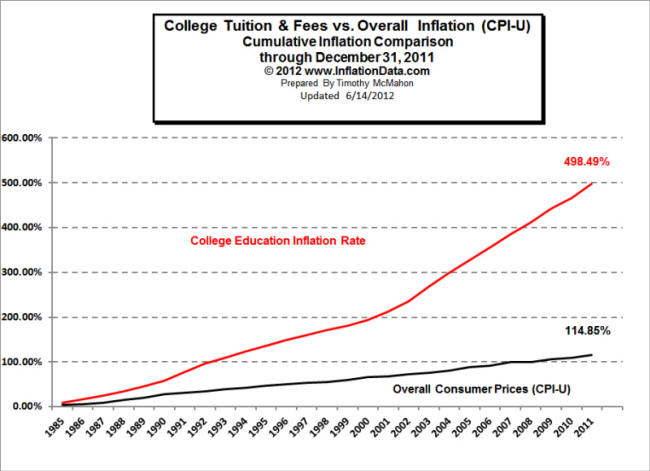

“A core American value is that each individual should have the opportunity to realize his or her potential. Birth needn’t dictate destiny. Education has been the traditional American pathway to opportunity and upward mobility, but this pathway is closing for a growing number of Americans in low- and middle-income families.” According to Laura D’Andrea Tyson, the former chairwoman for the Council of Economic Advisors for the Clinton administration. The education sector is one of the greatest casualties of the income inequality crisis in America. College completion rates quadrupled from 1915 to 1975 but have been stagnant since. In 1979 the difference in average incomes between those without a college degree and those with was about 38%. Today that figure is around 75%. This disproportionately affects lower income households in America. Not only because children in these households are not as encouraged to attend higher education but also the well known fact that the cost of college has skyrocketed. In fact the tuition of college (including room and board) in the past two decades has risen almost 4% a year, while the average inflation has tended to stay below 1% (10)

Figure 3.1

- Health Care:

“The effects of poverty such as obesity can be due to the need to purchase foods and drinks that are high in carbohydrates. Those living in substandard housing may suffer increased exposure to lead, asbestos, and other environmental hazards. Migrant workers can be exposed to pesticides, and herbicides. Many of our war veterans suffer mental illnesses leading to alcohol and drug problems, homelessness, suicide etc. In summary, poverty is what puts an individual at greater risk for a decreased life expectancy.” – Dr. Paul Manganiello, Professor, Physician, and a Volunteer at Good Neighbor Health Clinic, White River Junction, VT

For the first time in recent history, children born in certain parts of the United States can expect to, on average, live shorter lives than their parents. As a nation we are slowly realising an emergency in regards to the health and welfare of the lower class in America and poverty is one of the leading causes of death. Poverty as a cause of death may sound dubious, however there is a very clear and direct link between being poor and being at an increased risk for almost every cause of death. With factors such as increased secondhand smoking exposure, unfit sanitation, and increased lead exposure it is no wonder that being poor is a health hazard. And now that we have over 6 million more people living in poverty than we did in 2004, this is becoming a national crisis. (11)

Chapter 4: Solutions

We have had a long history of fluctuations in the income gap in America. We have seen cycles of it growing and shrinking as our overall economy steadily increases. Today we face a crossroads. As seen in historical examples we seem to be on the brink of an economic collapse similar to the recession of the late 2000’s. Fortunately, there are a few ways to solve this inevitable crisis. Some have been proven to work when implemented in the past and others offer a more permanent solution but do not have as extensive of a history.

- Redistribution:

Redistribution is the tried and true method of taking money from the richest and distributing it out among society, usually through government funded welfare and community well being programs. America has seen different states of wealth redistribution in its past. The new deal plans enacted in the Roosevelt administration in response to the great depression increased taxes across the board (79% tax on individuals making over $5 million a year) and used the money to create jobs for people to rebuild infrastructure. It also reformed banks and protected labor union’s rights to organize. As it turned out, the New Deal was wildly successful and ushered in America’s “Golden Age” when income inequality was at its lowest and the economy was growing the fastest it ever had.

There are proposals for income redistribution today. Bernie Sanders is the popular face of this proposal. In his 2015 campaign for president he ran on a platform that included many ideas that were similar to the New Deal and pushed redistribution such as taxing wall-street speculators, investing in a youth jobs program, lifting the cap on taxable income over 250,000$ and reenacting laws to protect and encourage workers unions.

Out of all possible solutions to income inequality, wealth redistribution is certainly the most likely and achievable one. All it would take is certain policy makers and politicians in certain positions, such as the presidential office that Bernie Sanders was vying for to add these types of laws little by little to shift the economy to a more balanced state as it was in the past. (8)

- Universal Basic Income

Universal Basic Income (UBI) is the idea of giving everyone a periodic cash payment that covers essential needs paid to everyone without discrimination. UBI has gained a lot of popularity recently as automation threatens to make the very idea of low-class jobs obsolete and the “Gig Economy” means less people are getting things such as healthcare and school discounts from their employers. UBI is not a new concept. Richard Nixon proposed a guaranteed income in 1970, but it died in congress. It is most likely that a UBI will not be enacted any time soon, as there is a lot of debate surrounding its cost and the potential for it to discourage work altogether. However, even in America there are UBI-like experiments that have been going on. Residents in Alaska receive anywhere between $1,000 and $2,000 a year for oil drilling and the eastern band of the Cherokee Nation receives around $5,000 a year for their casino chain.

These examples of course pale in comparison for the staggering cost of a monthly UBI for every citizen in the US. There have been studies with UBI in the US and Canada and though they report a decrease in the number of hours worked (between 7% and 17% fewer) they reported an increase in social well-being. (6)

- Other Possibilities

There are other solutions to the income inequality crisis that has been proposed. Some advocate for raising the minimum wage. This is not a bad idea, the minimum wage has not increased with inflation. If it were adjusted for inflation it would come out to around $10.55/hr. One potential downside with this is that it would encourage companies to install automation to replace human labor faster than they already are.

Another solution is to rearrange the budget to increase and expand welfare programs. This is somewhat like income redistribution but it does not necessarily require increasing taxes. This solution would include such things as: education and healthcare assistance, expanding social security and campaign finance reform. (8)

The Bottom Line

The bottom line is that our nation is facing a disaster. We have one of the worst cases of income inequality in the developed world and currently it shows no sign of being stopped. I have shown the problems this disaster has, can, and will cause if we are not able to find a way to allow all citizens to survive in our capitalist economy. Implementing a solution will be a slow and arduous fight against the established laws and policies that lock down the economy but it has certainly been proven to be possible before and I am sure it is still possible no matter how dire it seems.

Numbers in parentheses reference the “Resources” page.

Bernie Sanders campaign PSA

This is a video produced by Bernie Sanders campaign during his run for president. It details the recent movement of wealth in America from the lower and (disappearing) middle class to the richest of the rich. The video is meant to engage Bernie’s already passionate voting base and encourages them to share the information in the video among their Republican friends.

White paper, Economic Policies for the 21st Century as a model for my own white paper.

I chose this White Paper on the truth around American income inequality for the 21st century as a model for my own white paper.

The subject of this white paper is income inequality and mentions many of the points I plan on exploring in my own research such as; the exigence of exploring income inequality now, the history of income inequality and the methods employed in the 21st century that led to the current situation.

I will be able to use this paper as a source for my project. From what I’ve seen it is a rather unique look at the issue as it does not see the current economic climate in an exclusively negative light. In fact one of the points it makes is that, despite the existence of the wage gap, there aren’t many actual studies that link this to stagnating wages, reduced economic mobility and diminished opportunity to lower income children. While I disagree with much of the claims of this paper it will be very useful to understand the educated rebuttal to the national call for a change to income inequality.

The Journey Begins

Thanks for joining me!

Good company in a journey makes the way seem shorter. — Izaak Walton